Steadyyields Trade Highlights:

SteadyYields is a trading strategy that takes advantage of the correlation between long-dated Treasury Bonds and Crude Oil. The correlation has treasury yields trailing the price of crude oil by about two to four weeks. Here is some good research on this phenomenon:

https://seekingalpha.com/article/3271415-is-crude-oil-correlated-to-the-10-year-u-s-treasury-note

https://www.sciencedirect.com/science/article/abs/pii/S030142072100502X

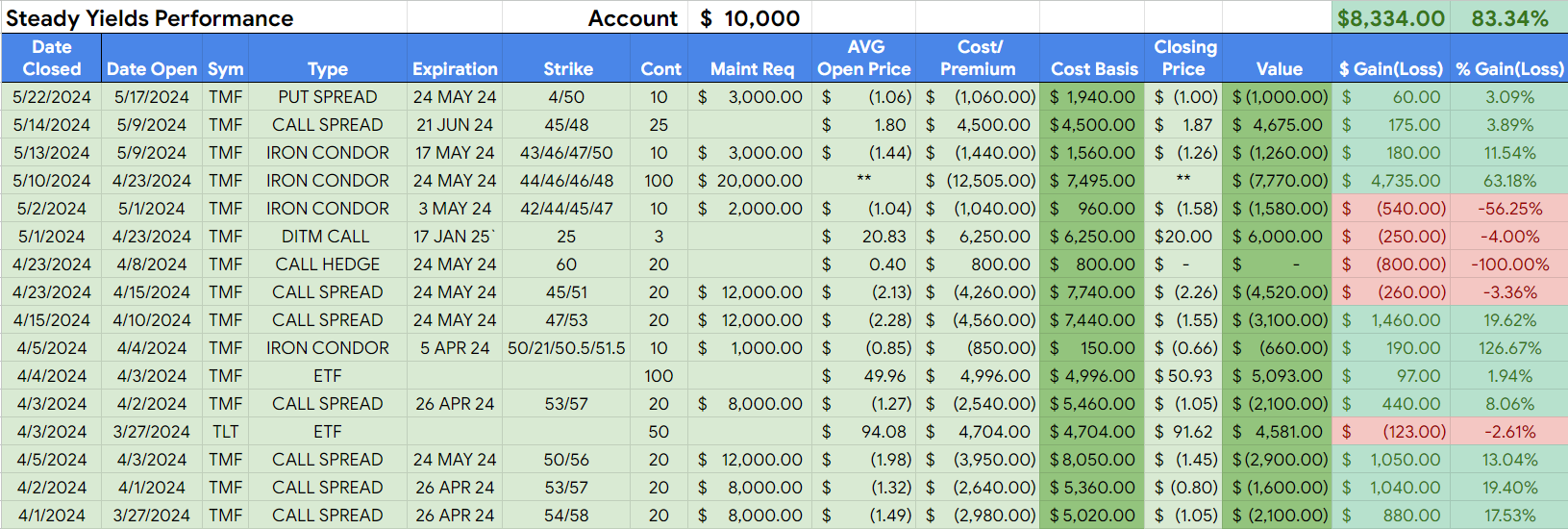

The strategy uses credit and debit spreads about 20-30 days from expiration. The spreads are designed to take advantage of the direction oil has provided, whether that be long, short, or neutral. Here is an excerpt from a live trade thread:

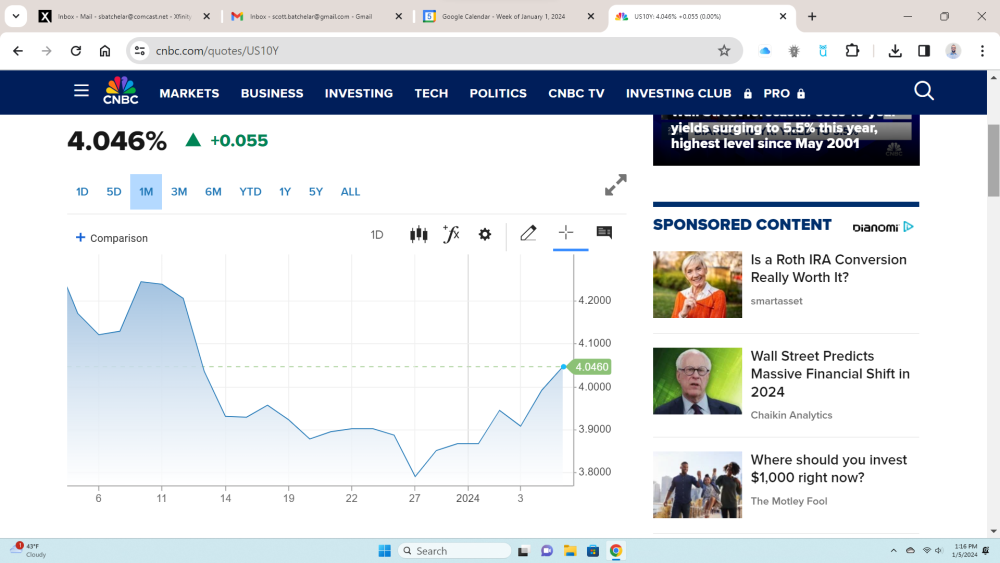

There is a definitive correlation between crude oil prices and the 10-year Treasury yield, which is led slightly by crude oil. That’s the edge. The option trades around this are endless. It makes sense: higher crude price, higher inflation, higher yields. However, in my opinion, it is mainly driven by the petrodollar system.

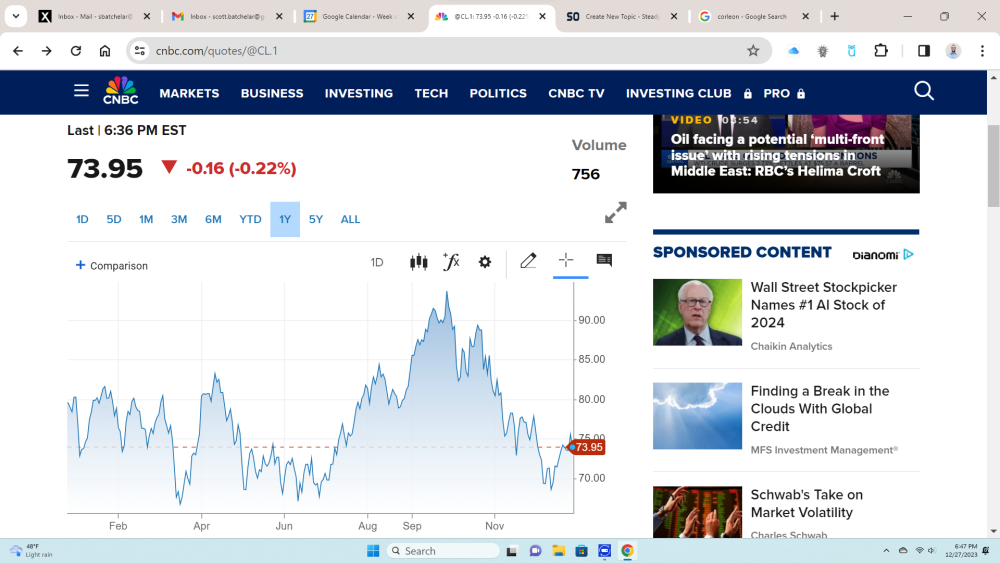

1-Year Chart Crude Oil:

Sure looks like the 10-year yield is about to move higher very soon.

And there’s the bounce.

As can be seen above, the direction of crude oil at about 3-4 weeks out is used to determine the direction of near-term Treasury yields. Treasury yields and bond prices move inversely, so yields and crude move inversely to the price of TLT/TMF.

The above are all of the trades that were executed in real time using this strategy in April and May of 2024.